Financial literacy month is officially here. During November, Canadians are encouraged to make a conscious effort about how they’re spending and managing their money.

Financial literacy essentially means being well-rounded, confident and knowledgeable when it comes to our personal finances.

It turns out that Canadians actually aren’t so well equipped for the task.

Enough to dedicate an entire month to it. 🙂

The government’s Canadian Financial Capability Survey from 2014 asked 14 questions about personal finance, and the national average score was about 62%. One person in three got at least half of the answers wrong, and only 2.7% answered all 14 questions correctly.

In other words, we’re collectively a C student.

Because, in very real ways, wealth is health.

Being financially literate improves your financial well-being. And better financial well-being can lead to better overall emotional, physical, psychological and spiritual health too.

Understanding even the basics of personal finances can help reduce stress, give you peace of mind, boost your confidence and set yourself up for success in many different ways.

People who don’t know how to manage their money face serious consequences, like having less money to enjoy life while they work and especially in retirement.

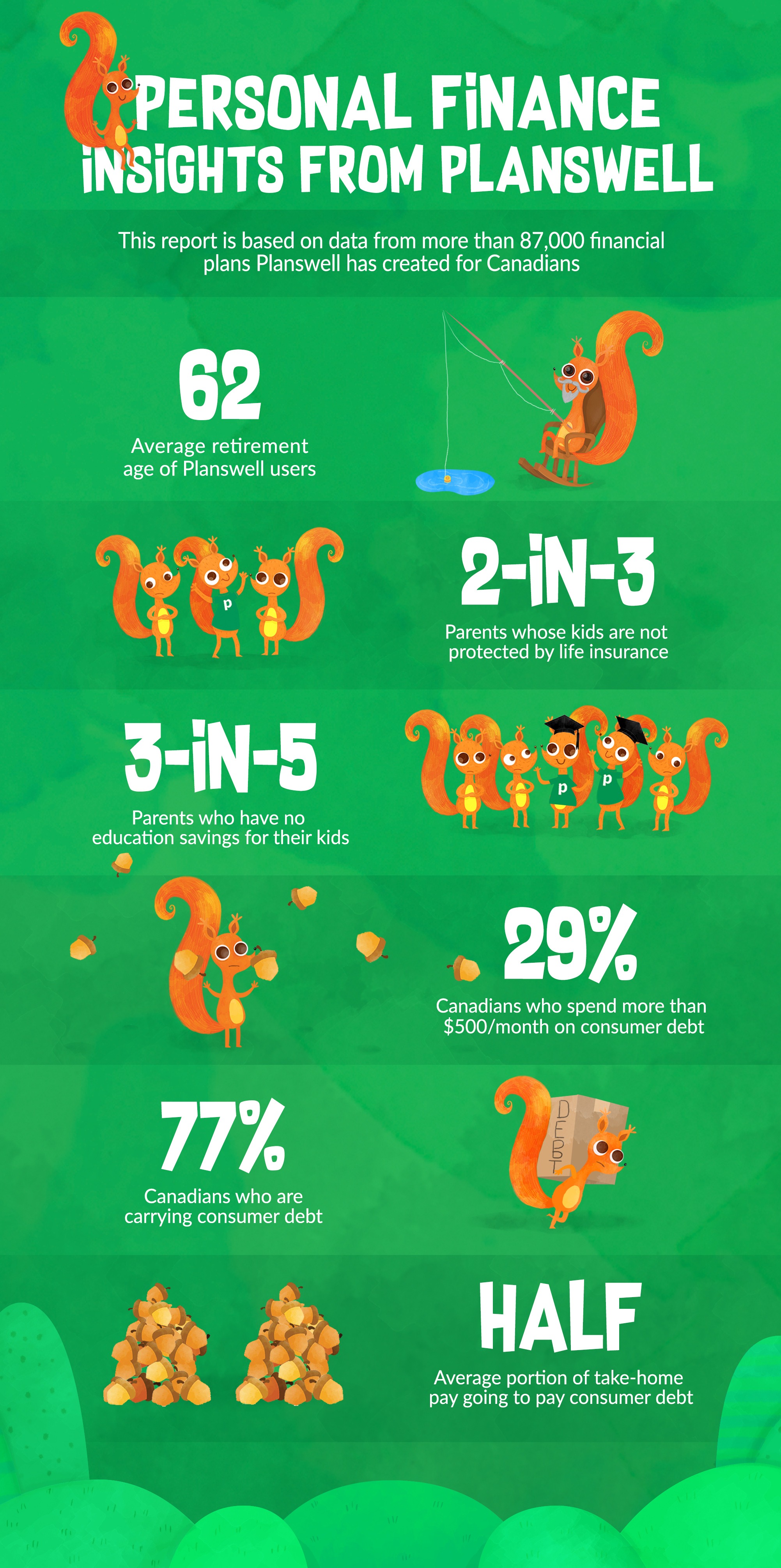

Being at the forefront of Canadians’ personal finances, we decided to explore the data from more than 87,000 financial plans that we’ve created for Canadians.

Here’s what we were able to discover:

77% of Canadians are carrying consumer debt on a monthly basis. This means that they’re likely having a hard time saving for their retirement among other financial goals due to the monthly burden of the debt they’re carrying.

3 in every 5 parents do not have education savings for their kids. This means that parents are not taking advantage of government programs to help their fund their children’s education. It also means that these children will likely come out of college or university with student debt.

2 in every 3 parents do not have life insurance to protect their kids. This means that if something were to happen to these parents, their kids could be left without enough to maintain the quality of life they have come to know.

With the sheer volume of resources available to Canadians such as financial planning books, articles, finance blogs, documentaries, etc., it’s surprising that financial literacy is such a widespread issue.

While there are numerous ways to learn about the topic of personal finance, most of them require a lot of effort. At Planswell we’re making personal finance easy, fun and accessible so that you can feel better about your money.

FINANCIAL LITERACY STARTS WITH A PLAN

The best financial plan is also the easiest.

Build your free plan today.

Start now