The long-awaited First-Time Home Buyer Incentive (FTHBI) is now in effect, as of September 2 – but how effective will be it really be in helping Canadians achieve homeownership?

First announced back in the federal March budget, this new initiative has prompted a number of questions and a fair share of criticism – while it is designed to alleviate the cost of entering the market for first-timers without stoking housing prices, its criteria has been considered too restrictive by many to really make a dent in the nation’s most competitive markets. But is this really the case in your local market? Let’s take a look at how the FTHBI will work, and who is most likely to benefit.

Under this new Incentive, the Canada Mortgage and Housing Corporation (CMHC), the federal government’s housing arm, will enter into shared-equity mortgage agreements with eligible home purchasers. This means it will lend cash infusions of either 5% toward the purchase of a resale home, or 5% or 10% for the purchase of a brand-new build, in exchange for retaining the same percentage of the home’s equity. The loan is registered on the home in the form of a second mortgage, and does not incur any interest. Because the money goes towards the down payment, it effectively shrinks the overall size of the mortgage – and that means monthly payments, total interest owed, and required CMHC mortgage insurance premiums will be reduced too.

The loan only needs to be paid back as a lump sum to the CMHC when the 25-year mortgage matures, or the home is sold – whichever occurs first. However, because it’s an equity loan, the amount paid back will reflect whatever the home’s assessed market value is at the time – and that could potentially be much higher than its original amount. For example, let’s say the CMHC provides a 5% loan of $25,000 for a home purchase of $500,000. The homeowner sells the home several years later, and its value has increased to $550,000. The homeowner would then need to pay the CMHC back $27,500 to reflect 5% of the increased value of the home. The same occurs if the home’s value goes down – if the home value at the loan’s maturation has been reduced to $475,000, then the homeowner would need pay back only $23,750.

To be eligible to use the FTBHI, home buyers have to satisfy a number of criteria, including:

However, it is these last two income and MTI requirements that have drawn the most ire from critics of the FTHBI, who say they are too limiting to be effective in Canada’s more expensive markets – where first-time buyers will arguably have the toughest time breaking into the market.

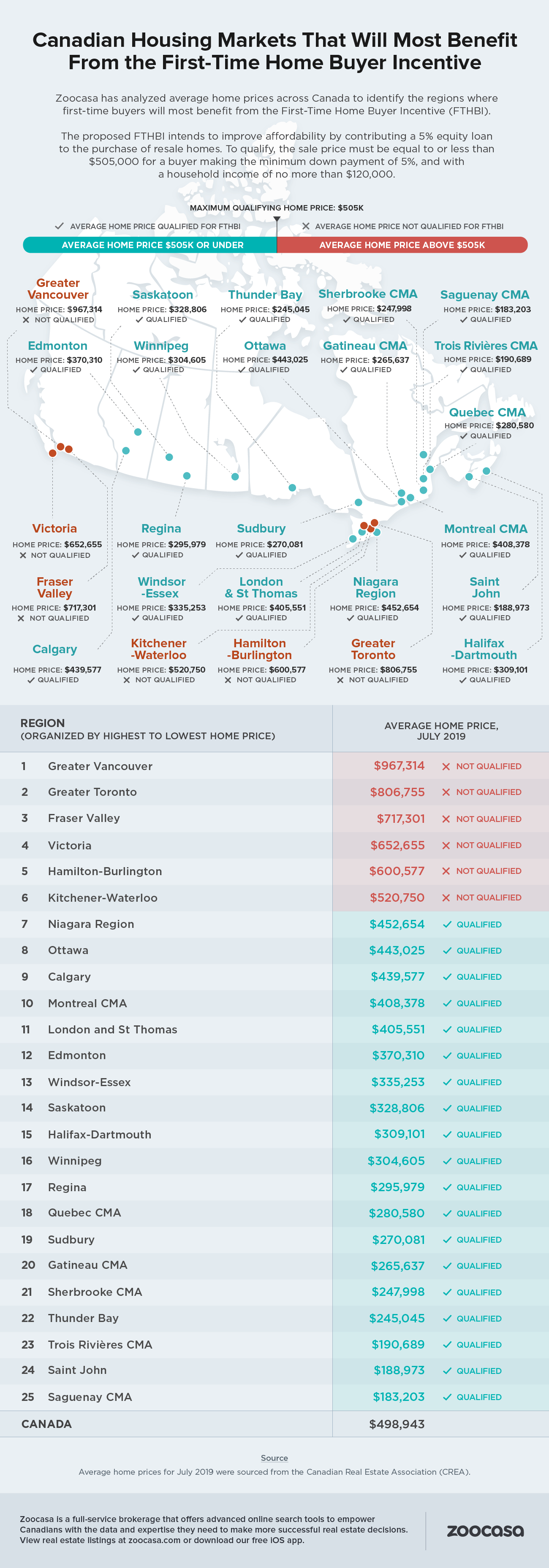

Because the mortgage taken out by the buyer cannot exceed four times their income, the maximum purchase price for a household with the maximum income of $120,000 and a 5% down payment saved would be $505,000 – quite short of the average $806,755 it takes to buy a home in Toronto, and $967,314 in Vancouver.

However, that’s not to say the Incentive is entirely toothless – in fact, according to analysis by Zoocasa of Canada’s top 25 major urban centres, a buyer looking to purchase the average-priced home could do so while utilizing the FTHBI in 19 cities.

The markets that remain out of reach include Toronto and Vancouver, as well as a number of markets in their direct proximities, including Fraser Valley, Victoria, Hamilton real estate, and Kitchener homes for sale.

However, it’s important to note that the study’s calculations are based on average home prices and maximum incomes; home buyers’ ability to use the FTHBI in each city may range based on their income, size of their down payment, and the price of their desired home.

Check out the infographic below to see where the FTHBI may be most utilized in Canada’s major cities:

Penelope Graham is the Managing Editor at Zoocasa, a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download our free iOS app.

YOUR FREE FINANCIAL PLAN

Are you ready to invest in your future?

Build your free plan today.

Start now