Ah, the American Dream: if you work hard, you can live a comfortable and prosperous life. But who wants to work hard? What if there were a way for you to make money without having to do much of anything at all? Now that’s a dream worth aiming for, right?

This is the promise of the BRRRR Method: to build a real estate portfolio that generates passive income all by itself without you having to do much of anything to manage it.

But is this dream actually realistic? It just might be. However, you are going to have to do some work on the front end to get yourself set up.

If you’re looking to get into the investment property game to earn rental income passively, the BRRRR Method is one way for you to do it.

Keep reading for a complete breakdown of the BRRRR Method: what it is, how to do it, and pitfalls to avoid during the process.

The BRRRR Method is a means of building a real estate portfolio that doesn’t rely on you having a huge chunk of disposable income on hand. The acronym stands for Buy, Rehab, Rent, Refinance, Repeat.

The basic idea is that you buy a distressed property (i.e. one that needs a little TLC to get it habitable) for a low price and renovate the apartments on a budget. Then, after you’ve rented the apartments out, you take a cash out refinance on the home and use the money to repeat the process.

Of course, actually doing all that is a bit more complicated than the previous paragraph makes it sound. Don’t worry: we’ve got a detailed breakdown of each phase in the plan.

Phase 1: Buy

Seems simple, right? Buy a house. Ah, not so fast, bucko: which house you buy is vitally important to your ability to capitalize on the BRRRR Method. There are a few considerations you must make when deciding whether or not a house will work for this particular real estate investing strategy:

Price

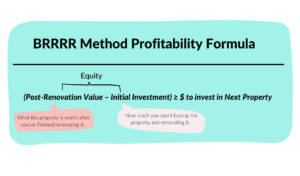

The whole premise of the BRRRR Method relies on your being able to increase the value of the home enough through renovation that you have enough equity for a down payment on the next property.

If the initial purchase price is high enough that you wouldn’t reasonably be able to increase the property value enough to be able to do this, it’s probably not a good target for the BRRRR Method.

Condition

The BRRRR Method by nature involves working with “distressed property,” so you should expect any house you purchase as a rental property for this plan to need work, both cosmetically and functionally.

But how much work is a necessary question to ask yourself.

Basically, you want the difference between the assessed value of the home after you’ve finished renovations and your initial investment in the property (purchase price plus renovation budget) to be greater than or equal to a down payment on the next property you’re interested in.

Generally, the kinds of repairs you’d rather not have to get involved with (because they’re going to cost you a lot of money) are issues with the foundation, roof, HVAC system, or any sort of serious water damage.

If you’re going to end up having to make serious repairs like those, you’ll want to make sure that the price of the property is low enough that you’ll still be able to create enough equity through repairs to be able to invest in a second property.

Location

Location is important to consider because it’s going to impact both the initial investment you make (homes with good locations cost more) and the rental income you can expect to generate once you have the place leased.

Here are some of the most important location-based factors to consider when vetting the location of a potential investment property:

Phase 2: Rehab

If you’re a real estate investor buying distressed properties to flip for rental income, you’re going to want to make sure you get the most bang for your buck when it comes to your renovation budget.

That means prioritizing renovations that are going to increase your property value as much as possible, while costing the least in terms of upfront investment.

Another consideration you’ll have to make as you’re planning out your real estate investment strategy is whether you’re going to do the work yourself, hire someone else to do it, or some combination of the two.

Of course, doing the work yourself will save you a lot of money, but it will require more effort on your part, and if you’re new to home renovations, the finished product may not look as nice as you need it to to get the appraisal or rent you’re looking for.

In either case, it’s likely you’re going to have to make some decisions about where to prioritize your renovation budget. Here are a few areas that tend to have the greatest impact on home value given the initial investment you’ll have to make:

1) Kitchen updates — even if you know the closest thing to cooking you’re ever going to do is reheating leftover pizza in the microwave, most people want to have nice, updated kitchens in their homes, and will pay quite a lot more for homes that have them. Replacing appliances, painting cabinets, and updating fixtures are relatively inexpensive as home renovations go, and will usually more than pay for themselves when it comes to their impact on the value of your property.

HGTV lists kitchen upgrades as one of the best ways to increase home value; they recommend a fresh coat of paint, upgrading to stainless steel appliances, and doing your best to make it look like a professional chef works out of your kitchen.

2) Curb appeal — first impressions are as important when assessing property values as they are at job interviews. When the assessor approaches your property, you want to ensure they think “oh, what a nice place” and not “this should be condemned.”

A nice shade tree, some well-placed potted plants, and freshly mown and edged grass could increase the value of your home by up to 15%, according to the American Society of Landscape Architects. A new coat of paint will do even more for your appraised value, and none of these projects will cost you much, relatively speaking.

3) Bathroom renovation — According to a survey conducted by the New York Times, how much a bathroom remodel increases the value of a property depends on where that property is located. Depending on the state or even the city, the cost of the work will vary, and what people are willing to pay for homes changes too.

Despite this, the survey showed that you will get some return on the investment no matter where you live. On the low end of the spectrum (Kansas), remodelers saw a 43% ROI; the best case scenario (Maine) saw a whopping 89% ROI for bathroom remodels.

The Times does note that the scope of the project is going to impact ROI as well: simply replacing the faucets in a bathroom that looks like it belongs in a frat house in every other way is unlikely to do much for you in terms of recouping costs.

4) Energy efficiency — Improving the energy efficiency of your home, either by replacing outdated appliances with Energy Star rated ones, upgrading to more efficient windows and doors, or even installing a solar array to help power your home, will increase its value.

According to research conducted by Freddie Mac, homes with high energy efficiency ratings sold for 2.7% more than those without.

However, will the increased value cover the cost of installation? Depends on where you live and what subsidies are available to you. If you live in a state with strong energy efficiency subsidies (like New York), it is highly likely that increasing the efficiency of your property will raise its value enough that you get a decent ROI.

Phase 3: Rent

Once your property is all shiny and new, you need to find tenants so you can rent it out. This may seem simple enough that no further explanation is necessary, but the waters of property management can be murky and treacherous if you aren’t careful.

Here are some considerations you’ll absolutely want to make before you put an ad up on Craigslist:

1) Get your lease checked

Nobody wants to have to go talk to a lawyer, but in this case, it’s probably a good idea. The cash you’ll pay them to review your lease and make sure it’s airtight is a lot less money than you’ll end up having to pay if a tenant sues you over breach of contract, or you can’t terminate a lease for whatever reason you might have to need to do that.

You can find template leases online that are probably okay, but the certainty of having had a professional review yours is, we believe, well worth it.

2) Vet your tenants

Don’t just accept the first person who responds to your ad as a tenant without doing your due diligence to ensure they’ll be able to make on time payments and will treat your property with respect.

You should require prospective tenants to fill out an application, verify their income, check other rental references, and require them to put down a security deposit and first month’s rent before you let them sign a lease.

Even if you end up sitting with a vacant apartment for longer than you’d like, a bad tenant can cost you more money than ten vacant rental properties, so make sure you take reasonable steps to avoid that outcome.

3) Take pictures

Even if you’re confident that your tenant will treat your rental property with the utmost respect, you should always take detailed and dated pictures of every inch of the property before you let someone else move in. And don’t just let them sit in the limbo that is your iCloud storage either: organize them so they’re easy to find.

In the event that a tenant damages the property in some way, you’ll want to be able to prove that you gave it to them in pristine condition just in case you end up needing to go to court.

4) Be a good landlord

If you get good tenants, you want to keep them. Not responding to maintenance issues or other tenant requests is a great way to drive the kind of tenants who will pay consistently and treat your rental properties with respect away.

A general rule of thumb is that if you treat your tenants well, they’ll treat your property well too — and vice versa. You want to make sure you aren’t the reason a tenant decides to start letting their place go.

Phase 4: Refinance

Once your property is spruced up and rented out, you can apply for a cash out refinance on the place. In order to do so, you’ll first need to get your property appraised. You can either order an appraisal independently, or go through your lender, though the latter option is likely less work on your end.

All you’ll need to do at this point is choose your lender and apply for the loan. Since you’ve already purchased property, you may have a lender you like already. That doesn’t mean it wouldn’t be worth shopping around and seeing who would give you the best rate on your loan, though.

Phase 5: Repeat

The cash out refinance you just got should give you enough money to speculate on the next property you’re interested in buying, and on you go, making the most of the BRRRR Method.

The rental income you’re receiving from the first property should be more than enough to cover the mortgage payment on that property, plus bank some away to handle any maintenance issues that pop up (and they will pop up).

There are several key benefits to using the BRRRR Method as a way to get into the real estate market.

1) Leverage:

The BRRRR Method allows you to build a real estate portfolio that functions as a passive income cash flow and won’t require you to have hundreds of thousands of dollars on-hand to invest because you use each property as collateral to secure funding to purchase the next one, all you need to begin is enough to buy your first property.

The result is that less established real estate investors can get their foot in the door without having to have huge amounts of capital on hand.

2) Cash flow:

Because this real estate investing strategy involves keeping the properties you purchase and renting them out, you build a fairly significant cash flow of passive income rather quickly as you begin to accumulate property.

3) Quick equity:

The passive income you gain from renting the apartments you renovate does more than just help you pay for future rehab costs — it can help you pay down your loans and build equity in the properties you own.

This is a valuable outcome for a couple of reasons: first, if you were paying PMI, you can quickly build enough to make that fall off. More importantly, however, is the ability to free up your properties’ value.

As you pay off your cash out refinance loans, you free up the equity in your property, which you could use to take out new loans to invest in more property, or simply eliminate the possibility of losing your property due to defaulting on the loan.

Despite all the exciting possibilities offered by the BRRRR Method, there are some pitfalls you’ll need to make sure to avoid.

1) Underestimate renovation costs

If your bottom line depends on capitalizing on the increased after-repair value of a property, spending too much money on renovations is a great way to ensure you don’t have enough equity to be able to purchase another property.

As such, it’s always best practice to overestimate renovation costs so you aren’t surprised when things don’t end up going your way come appraisal time.

2) Overestimate after-repair value

Similar to the first issue, if you assume your property will appraise for more than it actually does, you’re throwing a fairly huge monkey wrench in the whole BRRRR Method’s game plan. Predicting what a property is likely to appraise for can be tricky, too.

The real estate market fluctuates often, and so it’s essential to think critically about the purchase price and rehab costs of a house you’re considering using as a real estate investment.

If there’s a narrow margin of profitability that depends on getting a high appraisal, you may want to reconsider.

3) Property management problems

We touched on this earlier, but if the “rent” phase of the “buy, rehab, rent, refinance, repeat” plan is actually going to end up costing you money, you’d be better off not getting into real estate all together.

Tenants who don’t care for the apartment they live in can cause a serious amount of damage that can cost landlords far more than the security deposit they took.

This is why vetting tenants is so important: you want to ensure that the folks you allow to live in your income property will treat it with the same respect you would.

If the BRRRR Method seems like a bit more than you’re comfortable getting yourself into, but you still hope to get into the real estate investing game, there are some other options you can take advantage of.

Duplex living

Buying a duplex, living in one of the units, and renting out the other is a great way to be able to afford home ownership, generate rental income, and get started real estate investing without having to manage a portfolio of multiple properties.

The rent you earn from the second unit is likely to be enough to offset a significant portion (if not all) of your mortgage, which will, over time, free up disposable income for you to invest in a second property if you want.

Buy and hold

If you have enough cash on hand to be able to purchase some real estate that you don’t plan on living in, sticking with a single property is still generally an excellent investment strategy.

You won’t build a real estate investing empire in a few years like you feasibly could with the BRRRR Method, but you’ll own a piece of real estate that should appreciate in value and bring you rental income.

Fix and flip

If you aren’t interested in a part time job as a property manager, you could always eliminate the rental portion of the BRRRR Method and simply buy homes, rehab them, and then sell them for a profit.

You won’t enjoy the passive income that managing a portfolio of rental properties offers, but you also won’t have to deal with any tenants, either, which for some might just be worth it.

Airbnb

Another alternative if you aren’t interesting in managing a long term rental portfolio would be to purchase real estate with the intention of using it for short term rental income, like you might get through Airbnb or VRBO.

You’ll spend more time on average maintaining the property since you’ll have to turn it over more often, but on the other hand you’ll totally avoid any sort of uncomfortable legal situations that can often come up when dealing with tenants.

The “BRRRR” in the BRRRR Method doesn’t have anything to do with it being too cold out. It stands for “buy, rehab, rent, refinance, repeat,” which is basically a very simple instruction manual for how to implement the process.

The basic idea is that, through renovation and renting it out, you increase the value of your real estate enough to be able to take a loan out on the equity you created and use that to purchase and renovate a second property. And so on.

It’s of course an awful lot more complicated than that paragraph makes it sound, and there are some essential considerations you’ll need to make if you want to be successful.

If you plan on getting into real estate investing using the BRRRR Method, you should probably speak with an actual professional, and you should certainly read the unabridged version of this list:

1) What property to buy:

The real estate you purchase for the BRRRR Method needs to be cheap, but not too cheap. It can’t need so much work that the cost to renovate it is going to exceed its after-repair value. Actually, the value of the property once you finish renovations needs to exceed the down payment and renovation costs of the next real estate investment you’ve got your eyes on if you want this strategy to work.

2) What renovations to make:

The renovations that tend to cost the least and improve the value of your home the most are updates to the kitchen and bathrooms, improving the energy efficiency of the home, and doing some simple landscaping.

3) Renting your property out:

The ideal situation for a landlord is to have long-term tenants who pay rent on time and treat the property with respect. In order to achieve this, you’ll need to vet your tenants well and make sure you have a lease that’s actually legally binding.

Why use the BRRRR Method?

If you don’t have a ton of cash on hand and want to own multiple rental properties, the BRRRR Method is the way to go. By using the equity you build in your real estate as collateral rather than actual money on hand, you are able to grow a real estate property much more quickly than with other methods of real estate investment.

1) What’s the 70% rule for the BRRRR Method?

The 70% rule goes beyond the BRRRR Method. In fact, it’s a rule that many real estate investors ascribe to. It states that you should never spend more than 70% of the value of a property after renovations minus the estimated repair cost for the property.

The tricky thing is how to estimate those numbers accurately enough to ensure success. We recommend speaking with a professional prior to making any legally binding and financially significant decisions.

2) How much does it cost to start the BRRRR Method?

Your initial investment to get the BRRRR Method going is going to vary wildly depending on where you want to purchase real estate, but you can make a fairly educated estimation based on your target market.

First, look at the real estate prices for homes in the area you’re interested in on Zillow or Redfin. You should be focusing on distressed properties in desirable (or soon-to-be-desirable) neighborhoods.

Once you have a sense for what a piece of property is likely to cost, do some math:

Ideally, you’ll put 20% down when you purchase, and you should budget at least that much for renovations.

So, if you purchase a property for $100,000, you’ll need to have at least $40,000 on hand in order to be able to get started.

3) Is BRRRR better than flipping?

In some ways, yes. Investing in BRRRR property means you keep all of the properties you purchase, and so develop a portfolio of real estate that will appreciate in value over time, plus making passive income from rental payments.

When you flip a home, you get a larger chunk of money up front (which you could then use for a down payment on another property), but you miss out on the rental income and the potential for the value of the properties you buy to grow over time.

YOUR FREE FINANCIAL PLAN

Are you ready to invest in your future?

Build your free plan today.

Start now