Thinking of buying a home on a solo budget? You’ve likely heard the narrative that, with home prices rising exponentially in Canada over the last five years, you’ll be hard pressed to climb onto the property ladder with just one income. After all, two (or more) incomes don’t just pad purchasing power, but make it significantly easier to satisfy mortgage income requirements, too.

While affordability may have steadily eroded in the nation’s priciest markets – the average home price has spiked by 35% in the Greater Toronto Area and 58% in Vancouver over the last five years – that’s not to say single buyers are completely out of luck in their home buying ambitions. In fact, recent calculations made by Zoocasa reveal that that half of Canada’s major housing markets could still be considered affordable for someone earning the median single household income.

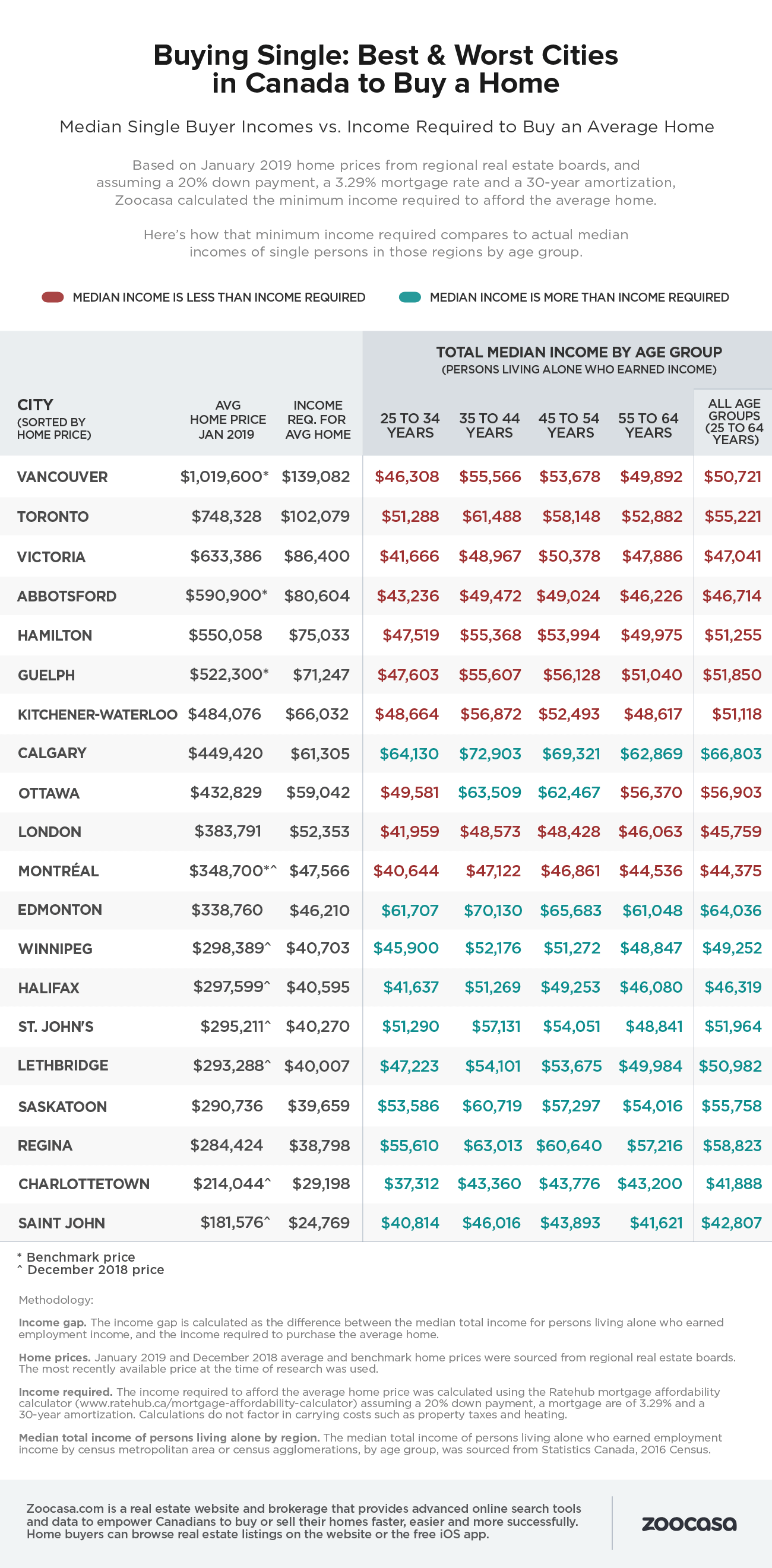

The study looks at 20 markets from coast to coast, assessing the average home price in each (as reported by their local real estate boards). It then calculates the minimum income one would need to earn to afford said abode, assuming the borrower makes a 20% down payment, gets a mortgage rate of 3.29%, and amortizes their home financing over 30 years. That amount was then compared to actual median income data of “persons living alone who earned employment income” as reported by Statistics Canada.

Based on this criteria, 10 markets can still be considered to be within the realm of affordability for a single home buyer seeking condos or houses for sale.

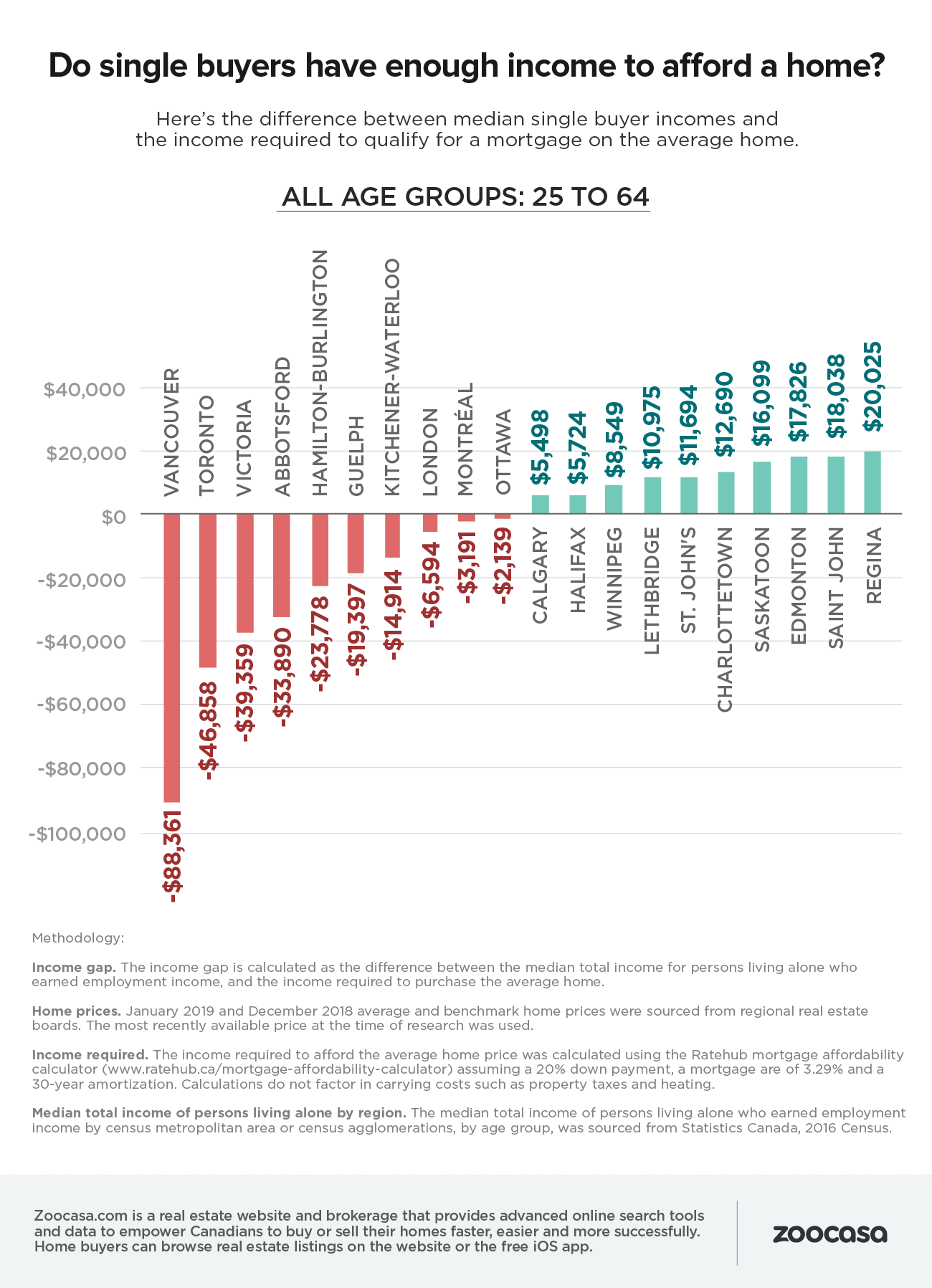

The greatest affordability can be found in Regina; there, someone earning the median of $58,823 could not only qualify to purchase a home at the average price of $284,424, but they’d have an “income surplus” of $20,025. This surplus represents the financial wiggle room the buyer would still have in their budget, meaning they’re not borrowing at the top of their affordability – an important precaution to take in a rising interest rate environment.

The other most affordable cities include Saint John, where the average home priced at $181,576 could be purchased on an income of $42,888 with $18,038 left over, and Edmonton, where earning $64,036 would net a $17,826 surplus on the average home price of $338,760. Calgary, Lethbridge, Winnipeg, and Halifax round out the markets that still fall within buyers’ budgets.

The market most out of reach for single buyers is, not surprisingly, Vancouver: with the average home fetching $1,109,600, a single buyer earning the median $50,721, would be $88,361 out of budget. It’s not much cheerier in Toronto, where an income of $55,221 would fall $46,858 on the average home price of $748,328, or in Victoria, where an average home price of $633,386 is still $39,359 out of range for the median income of $86,400.

Other markets not considered affordable for single buyers include Guelph, Kitchener-Waterloo, London, Montreal, and Ottawa.

While the Prairie and Eastern provinces proved to be the best bet for single buyers, the study also took into account purchasing power by demographics; it found that single Gen Xers (those in the age groups of 35 – 44 and 45 – 54) had the overall greatest purchasing power, with 11 markets (Ottawa being the swing city) within reach compared to 10 for Millennials (25 – 34), and Boomers (55 – 64).

In fact, single millennials have the toughest time out of any age group when purchasing a home, and especially those in the steepest markets. For example, for this age group, the income gap in Vancouver widens to $92,774. In contrast, a Gen Xer purchasing in the most affordable market of Regina would enjoy an even greater income surplus of $24,215.

Check out the infographics below to see how home buying affordability ranges in Canada by province and age group:

YOUR FREE FINANCIAL PLAN

The best financial plan is also the easiest.

Build your plan today.

Start now