For many Americans, debt has become the dead-beat roommate that just won’t go away: it hangs around eating your food and lounging on your furniture and it definitely doesn’t help you pay the rent.

In fact, as of 2023, the average American has over $5,000 in credit card debt, which, assuming average interest rates, costs about $1,000 per year per person.

Woof.

Given the prevalence of debt and its hefty impact on those who carry it around, we figured it would be helpful to gather some actionable advice for unshackling yourself from excessive debt so you can live your best life free from unnecessary stress and worry.

The reason most people think of debt as a four letter word (other than the fact that it literally has four letters in it) is because, when you allow it to hang around, it tends to grow faster than an eight-year-old’s interest in Pokemon.

Most accessible credit cards have interest rates between 18 and 24%, which means if you only make minimum payments, it could take decades if not longer to pay off the balance on your card.

If you miss payments, your balance could grow faster than you pay it off.

None of these situations is good.

However, responsible debt usage helps you build credit and improves your credit score, which earns you perks like lower interest rates and improves your access to large-scale loans, like mortgages. Plus, if you have a decent credit card, you’ll probably earn some rewards for using it, like miles you can redeem for free plane tickets or hotel stays.

The secret to maintaining “good” debt, is to ensure that you are able to pay off your entire credit card balance every month, so you don’t have to pay the mind-boggling interest they’ll charge you.

If your balance is carrying over from month to month, you do not have good debt, and should do whatever you can to pay it off as quickly as possible, especially if it’s high-interest debt like credit card debt is.

You don’t need to be Stephen Hawking to understand that eliminating debt, especially high interest debt, will benefit you in a number of ways. Saving on interest payments and avoiding late payment penalties are just the tip of the iceberg, however.

Here are four other benefits to reducing or eliminating debt that you may not even have thought about:

1) Lower stress and improved health

Ben Franklin was wrong — there are actually three certainties in life: death, taxes, and the shockingly detrimental effects debt has on a person’s physical and mental health.

You can barely throw a dart in a research library without hitting a journal containing at least one study confirming that increased debt leads to all sorts of mental complications, including anxiety and depression.

But excessive debt also impacts your physical wellbeing, mostly as a result of consistent high stress levels associated with worrying about being able to make debt payments all the time. In the most serious cases, unresolved stress can cause high blood pressure, heart disease, obesity, and even diabetes.

So, nipping your debt in the bud has a high chance of seriously improving not only your mental health, but your physical health as well. Even better, the positive feedback loop associated with relieving oneself from crushing debt can improve motivation, self esteem, and confidence.

2) Enhanced creativity

If you’re using 90% of your mental energy trying to figure out how you’re going to make rent and debt payments this month (not to mention having enough left over to feed yourself — and, potentially, your children) how could you possibly expect to have any remaining faculty to devote to creative pursuits?

Unshackled from the burden of financial worries, you’ll find that you have more mental energy available to pursue passion projects, whether they be creative or entrepreneurial in nature.

3) Improved credit score

Perhaps this isn’t all that unexpected, but a main factor in calculating one’s credit score is your debt-to-income ratio.

Even more impactful, however, is not missing debt payments on credit cards and other loans you might have. Making late payments will cause your credit score to deflate faster than the air mattress in your parents’ basement.

So, while eliminating debt won’t necessarily help you build up your credit score, it will certainly stem the bleeding from constantly missing payments.

4) Surprise savings opportunities

Even without considering the huge savings you’ll enjoy simply from not having to pay the astronomical interest on your credit card debt or penalties for late payments, there are plenty of ways that eliminating one’s debt can help you spend less day-to-day.

Many businesses (especially smaller ones without huge corporate backing) charge fees for using credit or debit cards to make purchases to offset the fees they’re charged for accepting cards. These can be up to 4% of the purchase price, which, if you’re buying something large, adds up quickly.

What’s more, having cash on hand gives you the leeway to take advantages of sales and promotions that could save you significant sums on all sorts of purchases, form clothing, to vehicles, to video games.

If you hope to ever live a debt-free lifestyle, you’re going to need to pay off all of the debt you’re currently struggling with without incurring more debt as you do so.

Here are four steps you can take that — assuming you actually follow them — will result in you being able to live a debt-free life.

1) Inventory your debt

Just because the average American has around $5,000 in outstanding debts, that doesn’t mean all of that debt is concentrated on one credit card or anything. In fact, most folks have various debt obligations, all of which will need to be satisfied if they hope to live a debt free lifestyle.

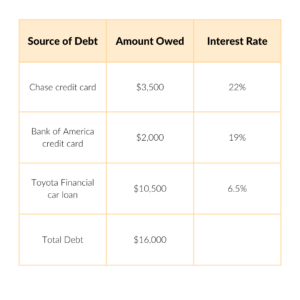

Therefore, your first step down the path towards debt-free living should be to take inventory of all the various debts you owe. We recommend using a table (like the one below) to list the following information: who owns the debt, the amount you owe, and the interest rate on the debt.

Once you have all your debt organized in a handy sheet, it will be fairly clear what kind of road you have ahead if you plan on living a debt free life.

One thing you can do to beat back any sense of hopelessness you might be feeling right now is to cross off debts that are going to be impossible to pay off with any sort of urgency and those that have relatively low interest rates (around 6 or 7% or lower).

Lots of times, there will be overlap between those two categories, which makes sense: interest rates on car loans and mortgages are going to be much lower than those on a credit card.

2) Create a monthly budget

Now, before you start making concrete plans to achieve a debt-free lifestyle, you need to know how much you can afford on a monthly basis to be spending on debt repayment.

We already wrote a blog that details how to make a budget, so we won’t go into too much detail here, but here’s a quick overview:

Determine your net monthly income

This is fairly simple: add up all of the paychecks you get in a month.

If you work in an industry where your pay changes based on time of year (perhaps you work in retail and get more hours during the holiday season), it may be a good idea to take a yearly average instead.

List your fixed expenses

Fixed expenses are monthly charges that are the same every time. Your internet bill, Netflix subscription, and mortgage payment are all fixed expenses.

List these, then add them up.

Calculate your variable expenses

Variable expenses change depending on your behavior or, sometimes, the environment. Your utility bill, grocery expenses, and gas purchases are all variable: you’ll (usually) have a higher utility bill in the winter, and you could change your grocery and gas spending based on your behavior.

The more data you can look at to calculate variable expenses, the better. So, we recommend tallying your variable expenses and taking a six month average at least.

Do the math

At this point, you should have the following information gathered:

That means you can do some simple math to determine how much extra money you have to put towards paying down your high interest debt:

Total net income – total monthly expenses = disposable income

Now, if you do this math and realize you have a budget deficit (your expenses are higher than your income) you know two things: First, this is probably what got you into debt in the first place. Second, you need to make some lifestyle adjustments in order to set yourself on the path to a debt free life.

If you find that you’re living with a budget deficit, it might be a good idea to see professional help. A financial advisor will be able to look at your specific situation and make recommendations for adjusting spending habits that will set things right.

If speaking with a professional isn’t an option for you, start by looking through your expenses and ordering them by priority. What are your must-have expenses — things like rent, and groceries — and what can you probably do without — just how many streaming services you’re subscribed to right now?

It can be extremely difficult to make decisions about where to be more frugal with your money (which is why professional help is recommended), but it’s absolutely necessary to reduce your expenses if you’re living with a budget deficit, especially if you h ope to live a debt free life someday.

3) Choose a debt-repayment strategy

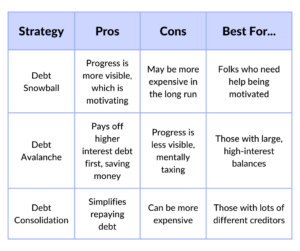

Once you determine how much money you have each month to use towards paying down debt, you need to decide what strategy you should use. There are a few worth mentioning:

Debt snowball

This strategy involves paying down your lowest-balance debts first. The idea is that, in the same way a tiny snowball gathers additional mass and momentum as it rolls down a hill, by checking smaller debts off your list, you too will gain momentum and motivation as you roll down the hill of your debt repayment plan towards the sunny valley of a debt-free life.

The debt snowball strategy might work well for those who have many different sources of debt, each of which has a relatively low balance, because you’ll be able to close out accounts relatively easily and therefore receive a more consistent dopamine bump each time you eliminate a portion of your debt.

If, however, you have fewer debt sources, or all of your debt sources have relatively high balances, this may not be the best option. It’s also worth noting that, while it may feel better to use the debt snowball strategy, because you focus on lowest balance debts first, you might actually end up paying more in interest over time than using other strategies.

Debt avalanche

Where the debt snowball strategy prioritizes good vibes and motivation as you walk the path to debt-free living, the debt avalanche takes a colder, more mathematical approach.

It dictates that, rather than focusing on what feels the best, you should pay off your debt in such a way that will save you the most money over time. So, focusing on eliminating the debt with the highest interest rate first.

This is more mentally taxing, since, especially if you have a sizeable chunk of credit card debt, it may take you years to be able to pay off a balance, which can be demoralizing.

Taking a balance from $500 to $0 feels WAAAAY better than taking a balance from $8,500 to $6,000, so employing a debt avalanche strategy requires the kind of mental fortitude typically associated with month-long hunger strikes.

Still, if you have what it takes to stick with a debt avalanche repayment plan even though it often feels like you aren’t making any progress at all, you will save money in the long run.

Debt Consolidation

If you’re living amidst an unwieldy bundle of financial obligations with a biodiversity of interest rates and due dates that make the Amazon rainforest look positively banal, debt consolidation might be the solution you’re looking for.

The basic idea is simple: you get a personal loan and use it to pay off all of your other debts, consolidating your debt into a single, monthly payment, which is usually less than the combined payments you were making to all of your other creditors.

Broadly, there are two ways to consolidate your debt:

1) 0% interest rate balance transfer credit cards

Depending on your credit score and how much debt you have, you may be able to cover your entire debt balance by making a balance transfer to a different credit card, one that has a 0% interest rate on balance transfers for a certain number of months.

This is the best option because (assuming you pay off the balance before you start incurring interest) you’ll only have to pay an origination fee (usually somewhere around 3% of the total balance transferred), since you aren’t being charged interest.

There are two issues, however, with this plan: first, if you have a lot of debt and a low credit score, you won’t be able to get a high enough credit balance to be able to cover all of your debt. Even with a credit score in the high 700s, you may only be able to get a $10,000 balance on a new card, which may be insufficient.

The second pitfall is that if you don’t make a plan to pay off your new card before you start accruing interest (and stick to it) you’ll end up in exactly the same position you’re in now: paying astronomical interest rates on high credit card balances.

2) Debt consolidation companies

If you have more debt than can be covered by a credit card’s maximum balance, or you don’t trust yourself to pay off the card before you start getting charged interest, you may consider a debt consolidation company.

Such companies (Best Egg and Upstart are two prominent examples) offer personal loans to individuals for a variety of reasons, though consolidating debt tends to be one of the most popular ones.

These companies will usually give loans up to $50,000 with much lower interest rates than credit cards, usually under 10%. What’s more, when you take out one of these loans, you are prescribed a set payment schedule, so you’re required to pay a certain amount each month. This means you don’t really have the option to “just pay the minimum payment this month,” which can be a helpful accountability measure.

These companies will also charge you an origination fee, so, if you also consider the interest you’ll pay, you’ll end up spending more money than if you consolidated your debt with an interest-free balance transfer credit card, but much less money than if you paid whatever incomprehensibly high rate credit cards charge you.

Which debt-repayment strategy is best?

Which strategy will best get you to a debt free life depends on your specific situation. Here’s a handy little chart that highlights some of the pros and cons of each:

4) Sticking with your debt repayment plan

Making a plan to eliminate your debt so you can live a debt free life is all well and good, but if you don’t stick to the plan, you’ll end up wasting a lot more than time. Here are a couple of considerations you’ll want to make to ensure that you’re able to follow your plan through to the end:

Sometimes, people go into debt because of an unavoidable situation, like a pricey medical procedure or an unexpected car repair. Other times, debt is the product of a series of financial decisions a person makes.

If you fall into the prior category, and are generally on top of your monthly spending habits, then there’s not really much work for you to do other than to pay off the debt in one of the ways we described above.

If, however, your debt is caused by a persistent budget deficit that’s a result of decision patterns you could change (like going out for coffee every day, or shopping at Brooks Brothers when you should be dressing yourself at Target), it’s important to know that.

Understanding your behavioral patterns is the first step on the journey to changing them, which tends to be necessary for anyone hoping to turn things around and live debt free.

If you’re struggling to juggle debt from multiple creditors with varying due dates and interest rates all over the map, you’re probably stressed out more often than not about meeting payment deadlines and worrying over whether you’ll have enough money to cover your obligations and make rent.

As it turns out, stress is detrimental to your physical and mental health. It can be the cause of all sorts of nasty problems, from anxiety and depression to heart disease and high blood pressure.

Eliminating such stress also has quite a few health benefits, from being more creative, to having more self esteem, and getting better sleep.

So, here are four steps you can take to set yourself on the path to living debt free:

Why is living debt free better?

Living debt free means you have absolute financial freedom rather than being shackled to monthly payments, which has so many benefits.

The lack of stress associated with living debt free can improve your physical and mental health, lift your credit score high into the sky, make you feel better on a general level, improve creativity, unlock opportunities to take advantage of savings or grow wealth, and so much more.

Is there a downside to being debt free?

Not really. Some might argue that completely eliminating debt would be harmful to your credit score, but that’s not exactly what we’re talking about here.

When we say living debt free, we don’t mean having absolutely no debt, we mean you put yourself in a position to fully cover any credit expenditures by the end of every month so you’re not making any sort of interest payments on debt.

This means you can still have and use credit cards, thus building credit and bumping up that credit score while also enjoying the financial freedom of not having any long-term obligations that weigh you down mentally and financially.

What debt should you avoid?

You should avoid high-interest debt that you can’t afford to pay off by the end of each monthly billing cycle. Any debt that is going to cost you money is bad debt and you should do whatever you can to eliminate it as soon as possible, even if that means making adjustments to your spending habits so you can make more than minimum payments every month.

YOUR FREE FINANCIAL PLAN

Are you ready to invest in your future?

Build your free plan today.

Start now