If parenthood is filled with priceless moments, that might explain why it costs so darn much.

But seriously, we’ve had long talks about the price of parenthood over here at Planswell. We’ve come to agree that there is a wide range of possibilities. You have a lot of control over the type of lifestyle you expect for yourself and your kids. And, somewhere between austerity and opulence, you’ll find the right place for you.

At the same time, parenthood introduces some financial needs that are unwise to ignore. Here are five things to think about when you’re not too busy coming up with baby names.

When you’re young and single, budgeting is pretty easy. Once you partner up and start really adulting, it gets more complicated. With a baby on the way, there’s a lot more at stake, and it’s time to get serious about understanding where you money goes each month.

Our child affordability calculator is designed to make this easier for you. We’ve listed many common expenses to help you think things through, as well as ones that aren’t as obvious so you don’t get blindsided. The tool is flexible so you can add or subtract items to suit your situation.

Budgeting is often compared to working out – it can be a slog at first, but it gets easier and even fun once it’s a habit, and the long-term payoff makes everything worthwhile. Give the calculator a shot and let us know how it goes!

Students are graduating with record amounts of debt these days. One way to avoid this problem is to save for college or university in advance using a Registered Education Savings Plan (RESP).

RESPs are great because you can invest your savings and watch them grow tax-free until a withdrawal is made for school. Even then, it’s only taxed at the student’s (low-to-nonexistent) tax rate. Plus, the government matches 20% of your contributions up to a maximum of $7,200 per child. And, as a bonus, if your budget is running a bit tight, you can invite family and friends to contribute to your kid’s plan. Hello, grandma and grandpa.

RESPs are a no-brainer, but our research shows that only 41% of parents are using one (in other words, 59% of parents have zero savings for their child). One word of caution: avoid so-called “group” RESPs, because they involve rules and fees that are not very friendly to your child genius. If you’re not sure who to trust with your RESP, give us a call.

If you work for a living, we would likely recommend that you have critical illness insurance and disability insurance. The purpose of these policies is to protect you financially if an accident or illness ever prevents you from making money and/or you get stuck with out-of-pocket medical expenses.

But once you have a child, there’s an additional person to protect, and the solution for that is life insurance. The idea is to have enough coverage in place that, if something ever happens to you, your offspring will still be able to cover their rent or mortgage, put food on the table, pay for tuition, and maintain all the other important elements of the lifestyle they enjoy now.

Term life insurance is sensible and cost-effective, yet only about 1-in-3 parents tell us they have coverage in place when they build their financial plans. We think it’s crucial to have this protection if you have dependents. Once your kiddo is self-sufficient, you can always let your policy expire or reduce the coverage amount.

Looking at data from more than 100,000 financial plans, we can see the financial impact of parenthood. On average, parents owe 26% more on their credit cards, loans and lines of credit ($22,914 vs. $18,189), and have 44% higher balances on their mortgages ($255,837 vs. $178,034) than non-parents.

Between paying for the essentials of life, investing for school, having an insurance safety net, and hopefully squeezing in the odd family vacation, the child affordability calculator can start to seem like a cruel joke.

But it’s still the best place to start. The first step in keeping debt under control is building a budget. Then, when debt becomes necessary, handle it in the smartest way possible. For example, if you own your home, use a mortgage to borrow at the lowest possible rate instead of paying higher rates on things like loans and credit cards.

Some financial outcomes are truly out of your control – such as whether the stock market will go up or down today – and we need to strive to let them go. Hopefully this article has shown you some of the things that are in your control, and how you can take positive steps to manage them.

Take heart in the fact that just about everybody worries that they won’t be able to provide absolutely everything they would like for their kids. Everybody wonders if they’re doing something wrong.

The solution is simply to do your best, and to carve out a bit of time on a regular basis to nurture yourself. Socialize, participate in a hobby, stimulate your body and mind. Give yourself a break so you can maintain positive energy, even when the going gets tough. Above all, know that the kid’s going to be just fine. You got this.

Questions? Concerns? Ideas for personal finance topics that might be helpful for parents? We’d love to hear from you.

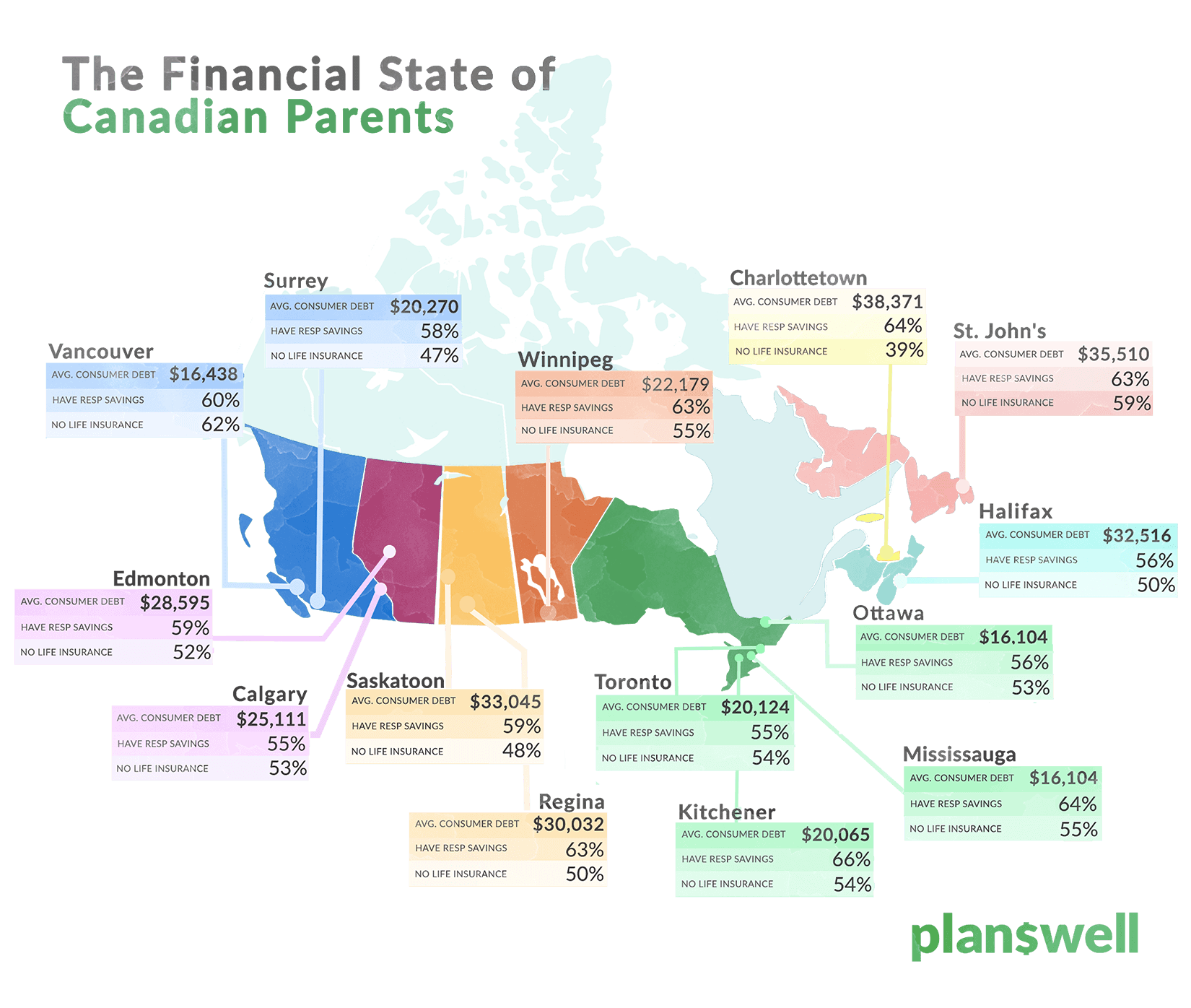

We pulled data from more than 120,000 financial plans built with Planswell to take a look at how parents across Canada are stacking up when it comes to the average amount of consumer debt they’re carrying, whether they have RESP savings for their children, and whether or not they have life insurance policies in place. See below for our cross-country averages broken out by major cities.

YOUR FREE FINANCIAL PLAN

The best financial plan is also the easiest.

Build your free plan today.

Start now