Do you want to set yourself up for financial success? Would you like to retire some day and not have to worry about whether you’ll have enough to live on? Do you feel like your money could be doing something more productive than loitering around your checking account?

If any of those questions hit home for you, keep reading: we’ve got five tips to help you get your financial house in order — now and in the long run.

Creating a budget is personal finance 101. If you’re going through life without the basic money management tool of a monthly budget, you may as well be wandering around the woods with a blindfold on.

If this is the first you’re hearing about all this, don’t worry: we’ve got you covered. We’ll explain what a budget is and outline the entire process of how to make one.

What is a budget?

A budget is an overview of your income and expenses, generally calculated on a monthly basis. This essential financial planning tool is designed to help you understand the financial resources you have at your disposal and plan for how to best allocate those resources.

Creating an accurate budget often makes it incredibly clear where you are overspending, and can not only help you plan to stop doing that, but also motivate you as well.

Believe me, nothing inspires a desire to spend less on food like being confronted with the reality that you spent $500 on Uber Eats last month…

How to make a budget

Making a budget is relatively easy, though it may take an hour or so of thoughtful calculating to do it right. Here’s how:

1) Determine your monthly income

You can’t do any sort of financial planning if you don’t know what resources you have at your disposal, so start by figuring out exactly how much money you have access to each month.

For the purposes of budgeting, you want to use your net income (i.e. the amount of money that actually gets deposited into your bank account after taxes and all that gets taken out).

There are a few ways you can do this:

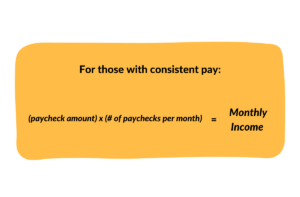

If all of your paychecks are exactly the same (either because you’re a salaried employee or you work the same number of hours each week), you can simply add up a month’s worth of paychecks and you’re done.

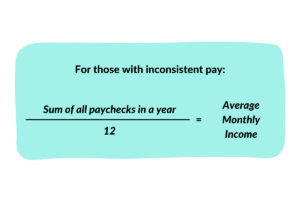

If, however, your pay varies either because you work inconsistent hours from week to week or because your schedule changes depending on the time of year (e.g. working overtime during the holiday season at a retail store or having access to more work during the summer as a landscaper), you’ll need to a little more work.

In these situations, you’ll probably want to calculate your monthly income as an average for the year. To do this, simply add up all of your paychecks for the past year and divide the total by 12.

2) List your fixed expenses

Fixed expenses are expenses that recur monthly and do not change, perhaps with the exception of very minor fluctuations. Here’s a fairly comprehensive list of the most common fixed expenses (though in special circumstances you may have fixed expenses not on this list):

NOTE: If you live somewhere where your electric/gas bill fluctuates wildly depending on the time of year, you may want to calculate your utilities as a variable expense instead using the formula discussed below.

3) Estimate your variable expenses

Variable expenses, as you might have guessed, change from month to month. Some of them change depending on the time of year it is, whereas some change depending on your behavioral choices.

Coming up with a comprehensive list of variable expenses isn’t really possible, because anything you spend money on somewhat consistently could be considered a variable expense, and there are simply too many things people spend money on somewhat consistently to be able to list them all here.

Nonetheless, here’s a list of some of the more common variable expenses:

4) Categorize Your Expenses

If you’re organized about how you add up your fixed and variable expenses, you can actually tackle this step as you complete steps 2 and 3. Basically, the idea is to assign a category to each of your expenses so you can calculate how much money you spend each month on, for example, “entertainment.”

The bullet points we used for common expenses in steps 2 and 3 would make fairly good category lists as well, though you can create as many or as few categories as you think would be useful.

(For example, if it’s important for you to know exactly how much money you spend on Uber Eats orders because you feel like maybe you’re doing it too much, perhaps you want to separate that out from the “dining out” category.)

5) Do the math

There’s a few sub-steps here.

First, you want to figure out if you have a budget surplus or a deficit. If you make more money than you spend each month, you have a surplus, which is awesome.

It means you have the freedom to save money, build an investment portfolio, or upgrade your lifestyle in some way. For more thoughts on how to spend your budget surplus, read the rest of this article.

If you’re spending more money each month than you bring in, on the other hand, you have a deficit. An unresolved budget deficit will result in you racking up some serious credit card debt in no time flat, so you’ll want to make adjustments as quickly as possible.

To figure out how to solve your budget deficit, you’ll want to calculate exactly how much money you’re spending on each of the different categories.

Look for patterns in the data you find. How much money are you spending on groceries? According to the USDA, an average family of four should expect to spend around $1,000 per month on groceries. If you’re doing that as a single person or even as a childless couple, you probably have room to cut costs.

What about entertainment? If you’re in the habit of going out drinking for fun on the weekends, that could very well be costing you thousands of dollars a month, depending on where you live and what you like to drink.

In drastic scenarios, you might even consider changing your housing situation to save some money. A common rule of thumb is that your housing payment should not exceed 28% of your overall income. If it does, you may want to downsize to help make ends meet.

Stick to your budget

Equally important as making a budget is sticking to it. All the careful financial planning in the world won’t make a difference if you don’t have the discipline to adhere to the budget you make. There are plenty of online listicles with various tips for sticking to a budget, but at the end of the day it comes down to willpower.

Whatever you have to do to force yourself to spend within your means is worth it in the end. Here’s just a few things that might be able to help:

Cancel your Amazon Prime membership

If you’re anything like me, it’s way too easy for you to buy stuff you don’t really need without thinking about it on Amazon. Cancelling your membership could very well end up saving you hundreds of dollars a month (not including the membership fee).

Pre-order your groceries

Making a grocery list is all well and good, but if you can’t control your impulse purchasing while at the store, order your groceries for curbside pickup.

This might cost you a little bit more than if you did your shopping yourself, but it’s worth it if it means you don’t spend an extra $50 or more per trip on stuff you don’t actually need.

Don’t buy alcohol at bars

The markup you pay for alcohol at a bar is just unbelievable. If you must drink, try inviting friends to your home to do it instead of going out (or do most of your drinking at home before going out).

You’ll be amazed how much money you can save.

Plus, if you’re drinking, you might be making other impulse purchases without thinking too much about them. After a few beers, spending $70 on bespoke socks starts to seem like a decent idea, even when it isn’t.

Before you think about meeting long-term financial goals like retirement planning or investing in your financial future, you’re going to want to set yourself up for success by eliminating any debt with high interest rates. For most folks, this is going to consist mostly of outstanding balances on credit cards.

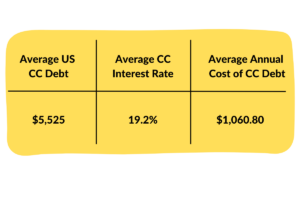

Not only is having too high of a credit card balance bad for your credit report, it’s also wildly expensive. Most credit cards’ interest rates hover between 18 and 24% annually.

If, like the average American, you have around $5,000 outstanding on your credit cards, that’s going to cost you about $1,000 per year unless you have an incredible credit score.

No investment you could make is going to appreciate at the rate high-interest debt will compound, so in terms of long-term financial planning advice, paying of such debt should be your number 1 priority.

You could take all the financial advice you’re given and be a financial planning whiz, but if you aren’t prepared for emergencies, it could all fall apart anyways.

Creating and contributing regularly to an emergency savings account is an important step to ensuring you are able to meet your long term financial goals.

In terms of how much money you want to have in your emergency savings account, most experts recommend between 3 and 6 months’ living expenses.

Don’t think of this as an investment, since you’re unlikely to get the same return in a savings account as you would if you put your money in the stock market, however that’s not really what this is for anyways.

Despite this, you can actually find banks that offer around 4% interest rates on certain high-yield accounts (as of 2023 anyways), which is way above historical averages.

Once you have your high-interest debt paid off and a decent start on an emergency fund, it’s time to start saving to meet long-term financial goals: i.e. planning for retirement.

You don’t have to be a professional financial advisor to figure out the sooner you start contributing to a retirement account, the better.

In fact, thanks to the magic of compound interest, if starting an Individual Retirement Account (IRA) at 25 instead of 35 could net you over $100,000 in additional earnings by the time you retire — that’s a lot of free money.

If you live in the United States, there are many different types of retirement accounts you could invest in, but we already wrote a blog about that, so we’re not going to go into all of the detail here.

We will, however, break down the major distinction that exists, which is between Traditional and Roth accounts.

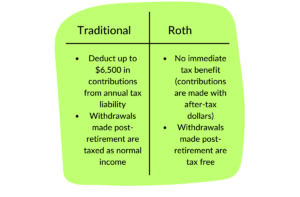

Traditional

Traditional retirement accounts give you tax benefits immediately. You contribute pre-tax dollars to them, and can deduct up to $6,500 in contributions from your annual tax liability (as of 2023).

So, if you’re in a position where you’re struggling to make ends meet, investing in traditional retirement accounts might be one way to ensure that you get more for your tax refund each year.

The downside here is that, when it comes time to retire, the withdrawals you make from a Traditional account will be taxed as any other income would.

Roth

Roth accounts, on the other hand, offer delayed tax benefits. You can’t claim your contributions to Roth accounts on your taxes, because you make them after paying taxes on the money you earn.

The benefit, however, is that when you retire, you can withdraw from your Roth accounts tax-free.

Which is best?

Generally speaking, investing in Roth accounts will result in you maximizing the amount of money you have overall.

Because people tend to earn more as their lives go on, it’s likely that paying taxes on your income earlier in life will be a better deal for you than waiting to pay them until after you retire.

Of course, this is a very general rule of thumb, and financial planning experts might have different advice given your specific situation.

At the end of the day, however, if you begin contributing to either of these types of accounts early in life, you’re going to be in a good place once you retire.

Understanding the ins and outs of personal finance is complicated, which is why, even though you’ve read this incredibly insightful and helpful blog, you should still speak with a financial advisor.

It’s impossible to give blanket advice on how to maximize one’s financial situation, because everyone has different personal finance needs. If it were that easy, financial advisors wouldn’t exist as a profession.

A certified financial planner can help you do more than just create a budget or financial plan or do better things with your money than letting it rot in a checking account; they can build your credit report, recommend financial products that can provide long-term value (like life and disability insurance), and help increase your overall financial literacy.

TLDR

If you’re looking to achieve both immediate and long-term financial success, we have five pieces of advice for you:

1) Create a budget

A budget is a road map to immediate financial wellness. If you don’t have one, it will be hard to plan for next week, let alone your future.

2) Pay off high-interest debt

Credit cards are the bane of many peoples’ personal finances. They have astronomical interest rates, which can cost hundreds if not thousands of dollars per year, depending on how much of a balance you carry.

High balances on such debts will negate any growth your investments make, and so you should absolutely make paying them down a priority.

3) Create an emergency fund

Stuff happens, and you should be prepared for it. No amount of savvy investment management can account for unforeseen disaster, and so best practice is to have 3 to 6 months of living expenses available in a liquid account just in case.

4) Plan for retirement

Once you have your debts under control and a solid rainy day fund, start an IRA. Whether you choose Traditional or Roth depends on when you want the tax breaks: now or later, respectively.

Regardless of which you choose, sooner is better. Starting your IRA at 25 as opposed to 35 could result in over $100,000 extra by the time you retire (and that’s after accounting for the extra money you’re investing in the extra time).

5) Speak to a financial advisor

Everyone’s financial situation is different.

The highly general advice we’re giving here may not apply to your specific situation, but a financial advisor will be able to take your specific needs into account and offer a financial plan that will help you live your best life now and after you retire.

They may even be able to help you retire sooner, or retire with more savings.

Who gives the best financial advice?

A professional financial advisor gives the best financial advice.

While you could read blogs like this or books by famous experts like Suze Orman or Dave Ramsey, only by speaking with a financial advisor can you ensure that the advice you’re getting is the best advice for you specifically.

What is the 50/30/20 budget rule?

This 50/30/20 budget rule states that you should try to set your budget up such that you’re spending 50% of your available income on “must haves” (like your mortgage and groceries), 30% on “lifestyle wants” (like going to the movies or buying dinner out), and 20% on savings and the like.

This is not a hard and fast rule, however, and financial advisors don’t always agree on the numbers (for example, there’s also a 50/15/5 “rule” where you spend 50% on necessities, 15% on retirement savings, and 5% on your rainy day fund).

Again, the best advice is to actually speak with a financial planner so you know you’re getting advice specific to your situation.

Can you live off of $1,000 a month after bills?

Absolutely, though depending on how many people you’re supporting on that $1,000 and how much fun you’re trying to have that might be more or less difficult.

A family of four on average spends $1,000 per month on groceries, so if you’re counting your housing payment as a bill, $1,000 should cover you (though it doesn’t leave much for fun).

YOUR FREE FINANCIAL PLAN

Are you ready to invest in your future?

Build your free plan today.

Start now