Your retirement planned well

Take our 3.5 minute questionnaire to get your free retirement and financial plan.

“I love that they make financial plans for you and actively are helping you to grow your wealth as a result. It’s a lot different compared to other financial advisory firms that once they have your money, don’t really seem to care about you.”

“As a single woman with a gaggle of children – who used to absolve herself of all financial responsibility – I can’t express the feeling of joy that comes from feeling of creating and embracing my own wealth and financial security. Grateful guys, thank you.”

“What I loved the most was seeing the big picture of my financial life. It was eye-opening how insurance and investing can work together to position me and my family for a better financial future.”

“Out of all the financial companies, you were the only one who took the time to give me all the mortgage information I needed.”

Planswell is a small but mighty start up that is passionate about financial planning and advice.

Our dream and mission is to create a world where everyone has access to financial education and peace of mind.

That’s why we partner with financial advisors all over Canada and the United States to help us on our mission to make financial planning and advice accessible to everyone.

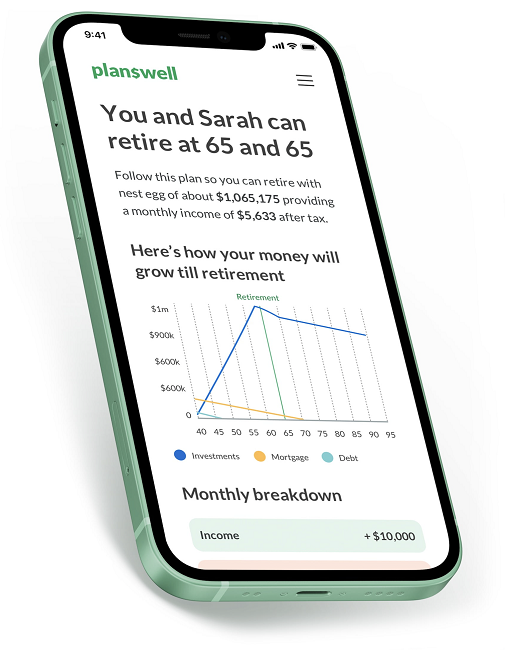

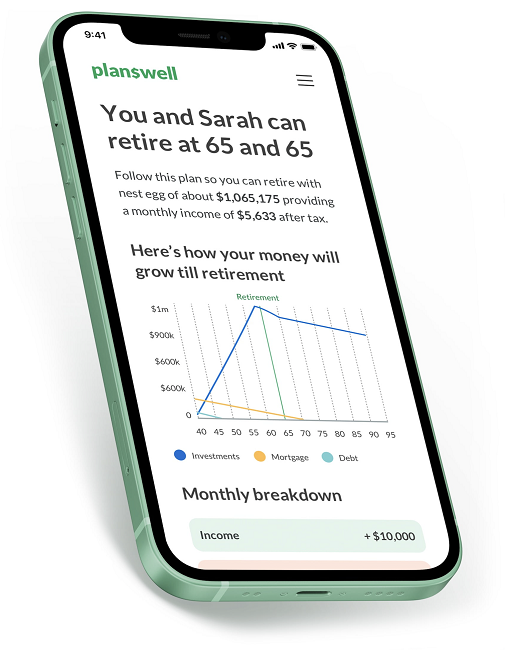

Our engine predicts what your total savings at your retirement age (nest egg) will be based on your desired retirement age, current savings, contributions and risk tolerance. We then create an optimized draw down strategy to hit that target income for life.

The engine tallies up your debt and finds ways to consolidate your debt to the lowest interest rate and free up your cashflow. Many people are surprised to see lower monthly debt payments!

The engine recommends how much money to put toward your various account types. It also takes into account how to optimize payments so you save money on taxes and maximize your retirement.

Any good financial plan includes insurance. The engine recommends how much insurance you need to protect your future income in the event that you pass away or become critically ill.

HAVE QUESTIONS?

Planswell will never ask you for financial account numbers, social security numbers, or other highly sensitive information. Information provided by you is protected with advanced data encryption via secure servers on a private network. From a practical point of view, we follow a clean desk policy with all sensitive information kept under lock and key.

Aside from our partners and service providers that assist us with running our business (financial services/products, anti-fraud, technology, communications, data analysis, legal and accounting partners) and those identified in the detailed long form below, we will not disclose, trade, rent, sell or otherwise transfer your personal information without your consent.

Yes, however, some recommendations in the plan may require a licensed advisor or agent, such as upgrading your insurance or remortgaging a home. Also, in many cases, a professional, human advisor can show you how some simple adjustments to your plan can make a massive impact on your lifestyle.

We encourage you to take advantage of your free plan review with one of our partners to see if any refinements are advisable.

Your financial plan and review with an advisor is completely free