Everyone wants to climb the financial ladder while avoiding mistakes that can drag us back down. Snakes and Ladders is a blog series where we see how Planswell is helping Canadians do just that. In this episode, we meet Andy, a young architect who thinks he’s pretty much in control of his finances. We’ll see about that.

Like most 23-year-olds, Andy’s idea of financial planning is more about saving for a big purchase or an awesome vacation than planning for retirement in 40 years. Before he met Planswell, he didn’t invest, didn’t have insurance, and was just sitting pleasantly on whatever was left after paying his bills each month. Let’s see what his plan recommended.

The first thing Andy’s plan told him was to put $308 per month into an RRSP account so that, when he reaches his 60s, he’ll be in a position to retire with the same standard of living he’s had all along.

“I thought that was compelling,” says Andy. “It’s hard to think too seriously about retirement at my age, but I really like the idea of having a big financial cushion to sort of protect me, then give me the option to stop working eventually. I was actually surprised that the amount I need to save fits with what I’m already saving.”

Head of Financial Planning, Mohamad Sawwaf, credits this surprise to what Einstein called the 8th wonder of the world: compound interest.

“Compounding means making money on your money,” Mohamad explains. “Timing is incredibly important because of the way compounding accelerates your growth.”

He gave this example:

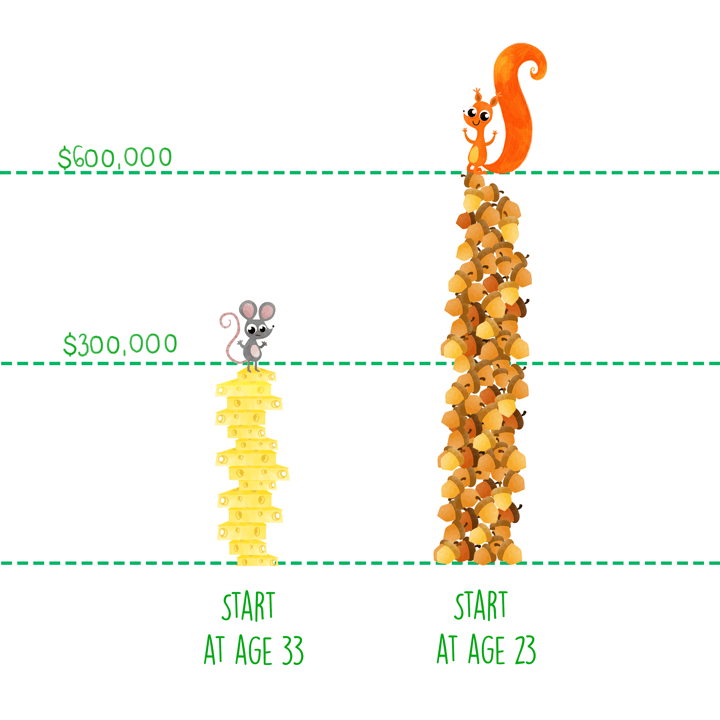

“Let’s say Andy puts $306 per month into his RRSP every month for the next 10 years, from age 23 to age 33. He’ll put away $36,720 during that time. If he invests in a portfolio that earns 6% per year, he’ll retire with almost $600,000 in his account. Now, look what happens if he waits. If he puts that same $36,720 away 10 years later, from age 33 to age 43, he’ll retire with barely $300,000. Only half the money!”

OK, timing is important. So is tax. Andy’s friend, who also made a plan with Planswell, was recommended a TFSA instead of an RRSP. What gives?

“It’s really about their income levels,” says Eric Rogness, one of our PlanPros. “Even though Andy and his friend are the same age, Andy makes more money, and that changes the tax calculation and our recommendation.”

We’ve written before about the difference between RRSP and TFSA accounts, but to put it simply, our engine calculates whether it’s better to reduce taxes now or in the future. For Andy, the best answer was to reduce taxes today.

Next, Andy got to the insurance section of his plan. Being a healthy, able-bodied young man, it wasn’t something he had ever thought about.

Eric explains: “Andy might think that his biggest asset right now is one of his material possessions, like a car or computer. But his biggest asset is actually his ability to earn around $2,000,000 over the rest of his career. He needs to protect that earning power. Spending less than a hundred dollars a month to protect potentially millions of dollars in future value is definitely worth it.”

Last year, Andy took a tumble at soccer, broke a bone, and missed two weeks of work. Luckily, he was able to use sick days and vacation days from work, but what if it had been something more serious? How would he have paid the rent?

The insurance recommendations in Andy’s plan were calculated to make sure that if an accident, injury or serious illness ever prevented him from working, his monthly take-home pay would still remain about the same.

“Before last year, anytime I got injured, I was in school or doing a part time job,” Andy told us. “This last injury really made me think about my health and how my job and my life could be impacted. I never really thought about how insurance could protect me personally until I saw my plan.”

Andy has no debt and does not own a home, so a mortgage recommendation was not part of his plan. But he knows that down the line, this is something that will come up. “We ask our clients to take a few minutes every six months to update their plan. Life happens, and these updates allow the plan to stay on target,” explains Eric. “When Andy starts to consider home ownership, we’ll be there to guide him.”

So what’s Andy’s takeaway from his experience? “I really like spending my money on things I can use now,” he admits. “Before getting this plan, saving for the future wasn’t a big concern. But my plan lets me spend what I want now, protect the income I have now, and still have even more to spend later. I’m really into this idea of eventually not having to work to earn money.”

Want to get a free personalized financial plan like Andy? Do it now.